Click here for a Sample Budget in Excel that can help you get started.

10 steps to help you get started on budgeting.

- Pray for wisdom, together if married (James 1:5), and for self-control, which is a fruit of the Spirit (Gal. 5:23). If we cannot control our spending, this is a spiritual problem.

- Before any spending, plan (with spouse) monthly expenditures and long-term goals (savings), based upon income and needs.

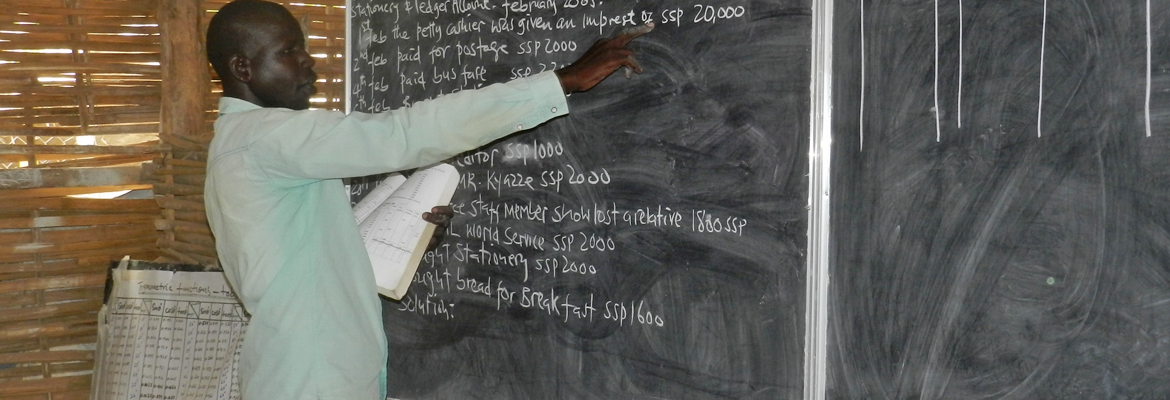

- Post daily expenses on a columnar ledger sheet or budget book or software program, such as Quicken™ or Money Matters™.

- Use the envelope system (place cash in envelopes designated for items such as auto, groceries, dining out, miscellaneous, etc—you can keep a running balance on the outside) or a columnar ledger sheet for running totals of individual budget categories.

- At month's end total expenses in each category and compare with your target budget and adjust for next month as necessary. Compare all expenses with all income.

- Post any surplus to savings, deduct any shortage from next month's income before spending next month's income. As savings grow, shift funds to higher interest-bearing accounts such as money market accounts or certificates of deposit (if the money will not be needed within the CD time period).

- At year's end, to help in tax filing and budgeting, total all expense categories, and divide by the number of months for which you've kept records. Use these figures to refine your budget.

- You may have to adjust the budget each month, depending on shifting regular income or expenses. Having the basic budget on a spreadsheet (such as Excel™) makes this easy.

- Expect to have unexpected expenses which throw off your budget. This is the reason for the emergency fund, into which you would put the equivalent of some months' income. You may have to borrow from other funds in the short-term. A budget may take 9-12 months to begin to work well.

- If you use software, set up both a checking and a "cash" account. On Quicken™, if you put them both on the same file, these can be merged for a more complete report. Also, if you use a check debit card (recommended), you will post those check expenses in the check register, along with regular checks, simplifying bookkeeping.

Summary

- Plan spending

- Record spending

- Total and compare spending

- Post surpluses

- Deduct any deficits

- Adjust budget as necessary

Resources:

- The How to Manage Your Money Workbook (2002, ISBN: 080241477X), by Larry Burkett, is a great Bible study workbook for individuals and couples who want to understand the biblical foundations of financial management. Family Financial Workbook (2002, ISBN: 0802414788), also by Larry Burkett, provides the steps and the forms needed for budgeting. Money Matters software is specifically designed for budgeting. These items can be ordered at 800.722.1976, and a current catalogue obtained of the many useful books available from Crown Financial Ministries.

- The Dome simplified budget book is available at office discount stores and is useful for recording and totaling expenses. Another method for recording expenses is to use columnar ledger sheets, which are available at office supply stores.

- Crown Financial Ministries (800.722.1976) offers excellent small-group financial training materials designed for use within a 10-week period.